Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

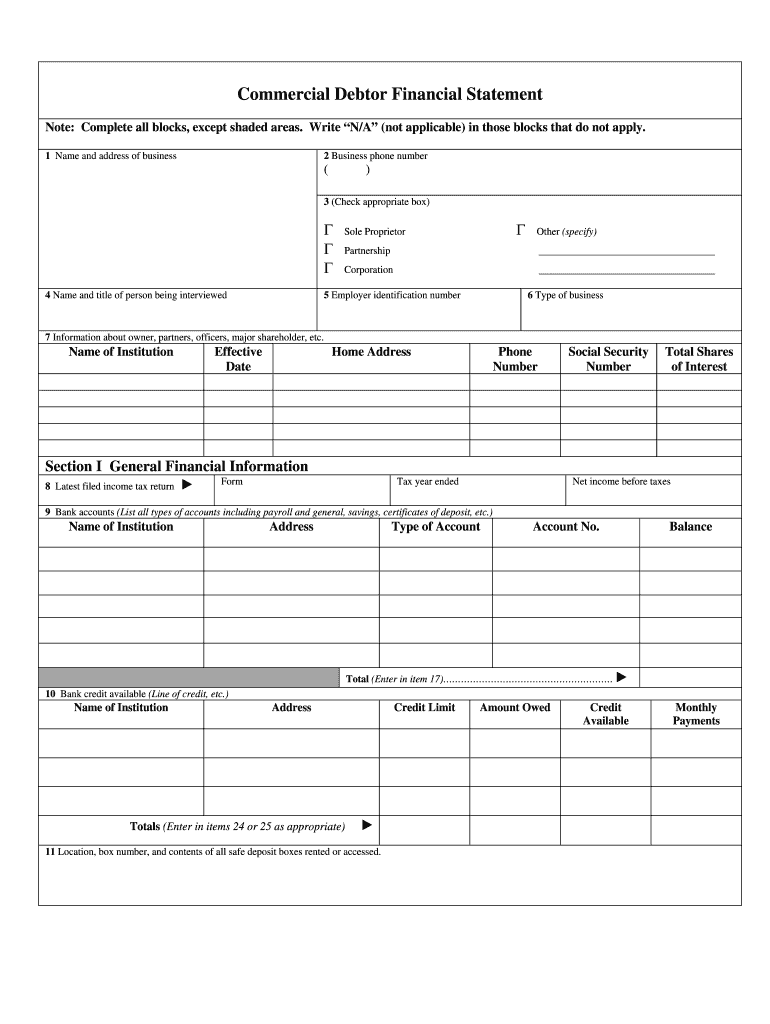

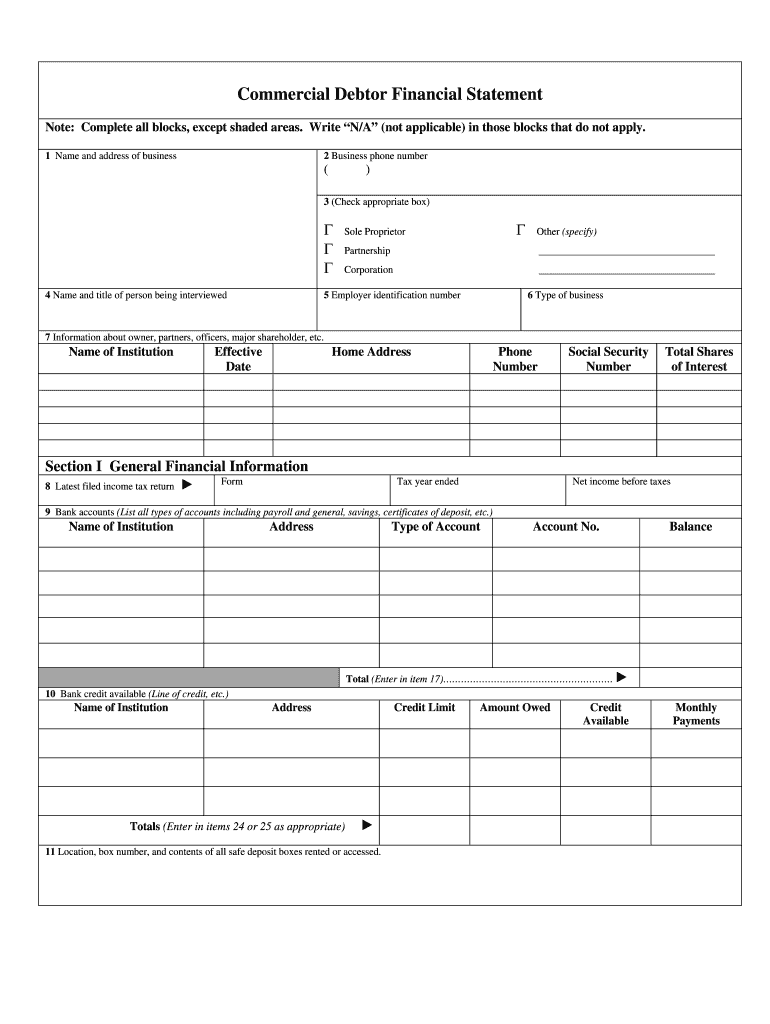

What is commercial debtor financial statement?

A commercial debtor financial statement is a document that provides detailed information about the financial position of a commercial debtor. It includes a summary of the debtor's assets, liabilities, income, and expenses. This statement is typically prepared by businesses or individuals who owe money to creditors and is used by lenders or creditors to assess the debtor's creditworthiness and ability to repay their debt. The information in the financial statement helps determine the terms and conditions of a loan or credit facility.

Who is required to file commercial debtor financial statement?

Commercial debtor financial statements are typically required to be filed by businesses or individuals who are seeking credit or loans from lenders or financial institutions. This includes corporations, partnerships, sole proprietorships, and other entities that need to provide their financial information to potential creditors or lenders.

How to fill out commercial debtor financial statement?

Filling out a commercial debtor financial statement involves providing accurate and detailed information about the financial position of your business. Here are the steps to fill out a commercial debtor financial statement:

1. Start with the heading: Write the heading at the top of the document, including the title "Commercial Debtor Financial Statement" and the date of preparation.

2. Business information: Provide the complete legal name, address, contact information, and other identification details of your business.

3. Financial statements: Prepare the financial statements for the business. This typically includes three components:

a. Balance sheet: List all assets (e.g., cash, accounts receivable, inventory, equipment) and liabilities (e.g., accounts payable, loans, mortgages).

b. Income statement: Include revenue, expenses, and net profit/loss.

c. Cash flow statement: Present the cash inflows and outflows, showing the business's ability to generate and manage cash.

4. Collateral information: If the debt is secured by collateral, provide details about the asset serving as collateral. Include the description, estimated value, and relevant documentation.

5. Business operations: Describe the nature of your business, its products or services, industry sector, and markets served.

6. Legal structure: Specify the legal structure of your business (e.g., corporation, partnership, sole proprietorship) and provide relevant registration details such as articles of incorporation or partnership agreements.

7. Owners/shareholders: List the names, contact information, ownership percentages, and total value of shares held by all individuals or entities with an ownership stake in the business.

8. Other liabilities and obligations: Detail any outstanding debts, loans, leases, or other financial obligations of the business.

9. Bank and creditor information: Provide the names and contact information of your business's bank and other major creditors.

10. Supporting documents: Include supporting documents that validate the information provided, such as bank statements, tax returns, financial statements, and legal contracts.

11. Authorization and acknowledgment: Sign and date the financial statement to indicate its accuracy and completeness. You may also need to have it notarized depending on the requirements of the creditor.

Remember, different institutions may have specific formats or additional requirements for commercial debtor financial statements. It is essential to check with the lender or creditor to understand their specific guidelines before filling out the form.

What is the purpose of commercial debtor financial statement?

The purpose of a commercial debtor financial statement is to provide a detailed overview of a business's financial position, performance, and cash flow. It is typically used by lenders, creditors, or investors to assess the creditworthiness and financial health of a business before entering into a business relationship or extending credit.

Key information included in a commercial debtor financial statement may include the business's assets, liabilities, equity, revenues, expenses, cash flow, and other financial data. This information helps creditors evaluate the business's ability to repay debts, its profitability, and its liquidity. It provides insights into the business's financial stability, risk profile, and potential for future growth.

What information must be reported on commercial debtor financial statement?

When reporting on a commercial debtor's financial statement, the following information must typically be included:

1. Company Information: The legal name, address, and contact details of the commercial debtor.

2. Financial Statements: A complete set of financial statements, including the balance sheet, income statement, and cash flow statement. These statements should cover a specific period, usually the past three years.

3. Notes to Financial Statements: Any accompanying notes that provide additional details or explanations regarding specific line items or accounting policies.

4. Assets: A detailed listing of the commercial debtor's assets, including cash and cash equivalents, accounts receivable, inventory, property, plant, and equipment, investments, and any other significant assets.

5. Liabilities: A breakdown of the commercial debtor's liabilities, including accounts payable, loans, leases, accrued expenses, long-term debt, and any other outstanding obligations.

6. Equity: Information on the commercial debtor's equity, such as the capital stock, retained earnings, and any other equity accounts.

7. Contingent Liabilities: Disclosure of any potential liabilities or obligations that may arise in the future, such as legal claims or warranties.

8. Related Party Transactions: Any transactions or dealings with related parties, including significant shareholders, directors, or other entities with close business relationships.

9. Significant Accounting Policies: Explanation of the principles and methods used in preparing the financial statements, including revenue recognition, inventory valuation, depreciation methods, etc.

10. Subsequent Events: Any significant events or transactions that occur between the balance sheet date and the date of the financial statement reporting.

It is important to note that the specific reporting requirements may vary depending on the accounting standards followed (e.g., Generally Accepted Accounting Principles - GAAP or International Financial Reporting Standards - IFRS) and any applicable regulations or industry-specific guidelines.

What is the penalty for the late filing of commercial debtor financial statement?

The penalty for late filing of a commercial debtor's financial statement can vary depending on the specific jurisdiction and legal requirements. In some cases, there may be monetary fines or penalties imposed for late submission. Additionally, late filing may result in negative consequences such as being denied credit or financing opportunities, losing discounts, or being subject to legal action by creditors. It is recommended to consult with a legal professional or relevant authorities to understand the specific penalties and consequences that apply in your jurisdiction.

How do I modify my commercial debtor financial statement in Gmail?

It's easy to use pdfFiller's Gmail add-on to make and edit your commercial financial statement form and any other documents you get right in your email. You can also eSign them. Take a look at the Google Workspace Marketplace and get pdfFiller for Gmail. Get rid of the time-consuming steps and easily manage your documents and eSignatures with the help of an app.

Can I create an electronic signature for the consumer debtor financial statement in Chrome?

Yes, you can. With pdfFiller, you not only get a feature-rich PDF editor and fillable form builder but a powerful e-signature solution that you can add directly to your Chrome browser. Using our extension, you can create your legally-binding eSignature by typing, drawing, or capturing a photo of your signature using your webcam. Choose whichever method you prefer and eSign your fms financial statement in minutes.

How do I fill out debtor financial statement using my mobile device?

Use the pdfFiller mobile app to fill out and sign commercial debtor financial statement on your phone or tablet. Visit our website to learn more about our mobile apps, how they work, and how to get started.