Get the free commercial debtor financial statement

Show details

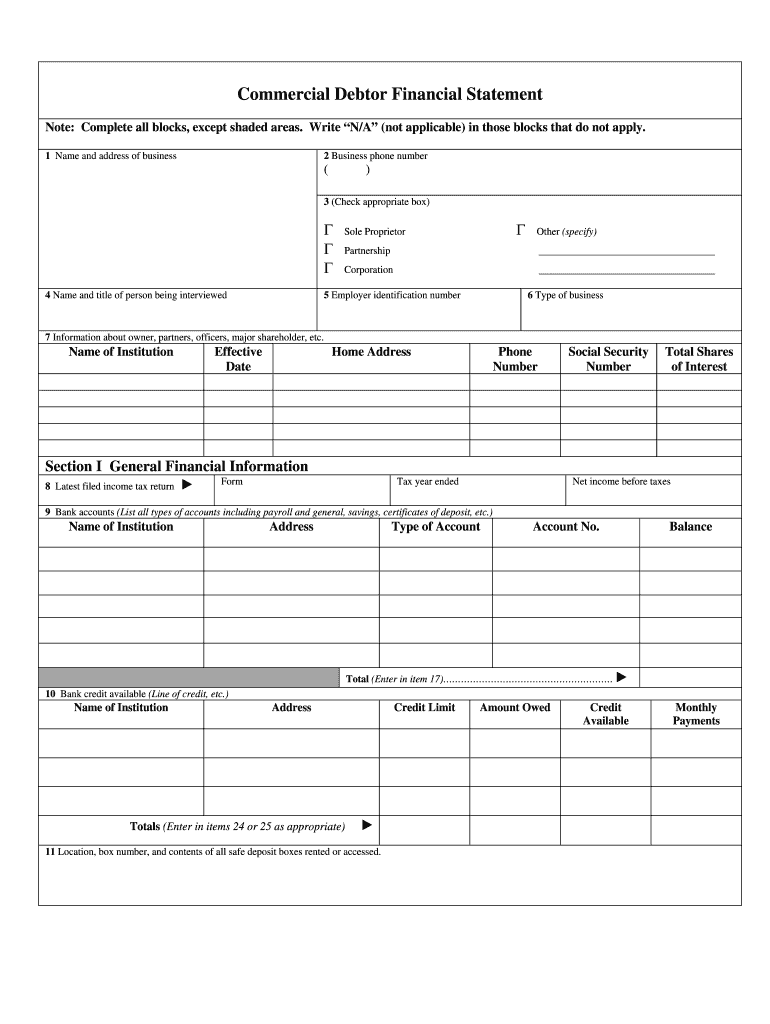

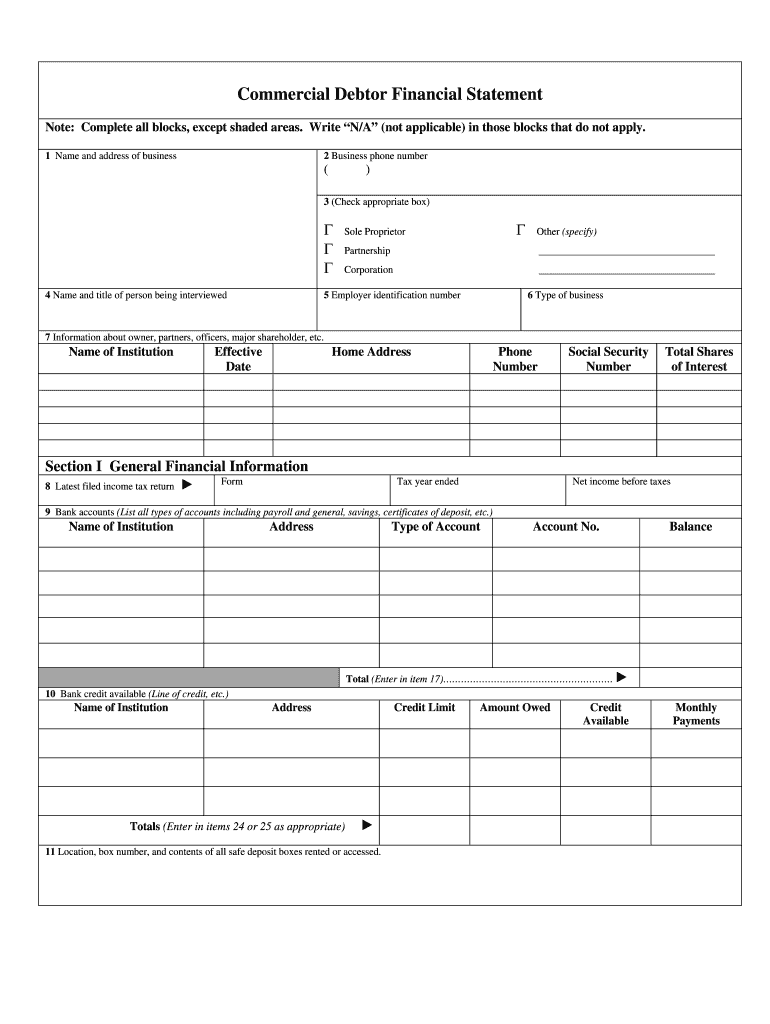

Commercial Debtor Financial Statement Note Complete all blocks except shaded areas. Write N/A not applicable in those blocks that do not apply. 1 Name and address of business 2 Business phone number 3 Check appropriate box 4 Name and title of person being interviewed Sole Proprietor Other specify Partnership Corporation 5 Employer identification number 6 Type of business 7 Information about owner partners officers major shareholder etc* Name of Institution Effective Date Home Address Phone...

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign fms financial statement form

Edit your commercial financial statement form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your consumer debtor financial statement form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing include detailed financial information such up to date figures online

In order to make advantage of the professional PDF editor, follow these steps:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit financial statement of debtor form. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

With pdfFiller, it's always easy to deal with documents. Try it right now

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out commercial financial statement form

How to fill out a commercial debtor financial statement?

01

Gather all necessary financial documents: Before filling out a commercial debtor financial statement, make sure to collect all relevant financial documents such as balance sheets, income statements, bank statements, tax returns, and any other supporting documents.

02

Provide accurate personal information: Start by entering your personal details, including your full name, address, contact information, and social security or tax identification number. Ensure that all the information provided is accurate and up to date.

03

Disclose business information: Include comprehensive information about your business, such as the name, legal structure (corporation, partnership, sole proprietorship, etc.), industry, date of establishment, and any other relevant details. This section is crucial as it helps the creditor understand your business and its operations.

04

Provide financial data: This is the most critical section of the commercial debtor financial statement. Include detailed financial information such as your total assets, liabilities, equity, revenues, expenses, net income, cash flow, and any outstanding loans or debts. Make sure to provide accurate and up-to-date figures.

05

Include supporting schedules: If necessary, attach supporting schedules to provide further details on specific aspects of your financial statement. This could include detailed breakdowns of accounts receivable, inventory, fixed assets, or any other relevant information. Ensure these schedules are organized and easy to understand.

06

Sign and date the statement: Once you have filled out all the necessary sections, review the information for accuracy and completeness. Sign and date the commercial debtor financial statement to indicate that the information provided is accurate to the best of your knowledge.

Who needs a commercial debtor financial statement?

01

Lenders and financial institutions: Banks and lending institutions often require commercial debtor financial statements to assess the creditworthiness and financial stability of a business before extending loans or credit facilities.

02

Trade suppliers and vendors: Some suppliers and vendors may request a commercial debtor financial statement to evaluate the financial health and capability of a business to make timely payments for goods or services.

03

Investors and potential business partners: Investors, venture capitalists, and potential business partners may request a commercial debtor financial statement to assess the financial viability of a business and determine its potential for growth and profitability.

04

Legal entities: In legal matters such as bankruptcy cases or financial disputes, commercial debtor financial statements may be required to provide a comprehensive understanding of the debtor's financial situation.

05

Government agencies: Certain government agencies may request commercial debtor financial statements for regulatory compliance, tax assessment, or eligibility for specific programs or incentives.

Fill

who is required to file undefined

: Try Risk Free

People Also Ask about debtor statement

How is debt recorded on balance sheet?

A company lists its long-term debt on its balance sheet under liabilities, usually under a subheading for long-term liabilities.

What is a statement of debtor?

Most businesses prepare a debtor statement once a month so that their customers and clients are fully up to date on any and all outstanding payments. Although the format can vary, a debtor statement will: Give you a general overview of any outstanding payments owed by each customer.

Are debtors a current asset?

Yes, debtors are recorded as current assets in a balance sheet as payments are expected to be received from them in the current accounting period.

What is a financial statement of debtor?

The purpose of this Statement of Finances is to determine the debtor's financial situation so that satisfactory payment arrangements to clear the arrears can be made. The statement provides a sworn summary of the debtor's income, expenses, assets and employment.

What is a debtor on a balance sheet?

If money is owed, the party that owes the money is known as the debtor on the balance sheet of the party that is owed the money.

Where do you put debtors on a balance sheet?

Debtors are shown as assets in the balance sheet under the current assets section, while creditors are shown as liabilities in the balance sheet under the current liabilities section.

Our user reviews speak for themselves

Read more or give pdfFiller a try to experience the benefits for yourself

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my debtor statement template in Gmail?

It's easy to use pdfFiller's Gmail add-on to make and edit your treasury consumer financial statement and any other documents you get right in your email. You can also eSign them. Take a look at the Google Workspace Marketplace and get pdfFiller for Gmail. Get rid of the time-consuming steps and easily manage your documents and eSignatures with the help of an app.

Can I create an electronic signature for the debtors statement in Chrome?

Yes, you can. With pdfFiller, you not only get a feature-rich PDF editor and fillable form builder but a powerful e-signature solution that you can add directly to your Chrome browser. Using our extension, you can create your legally-binding eSignature by typing, drawing, or capturing a photo of your signature using your webcam. Choose whichever method you prefer and eSign your debt statement in minutes.

How do I fill out simple financial statement using my mobile device?

Use the pdfFiller mobile app to fill out and sign statement of financial details for debt repayment form on your phone or tablet. Visit our website to learn more about our mobile apps, how they work, and how to get started.

What is commercial debtor financial statement?

A commercial debtor financial statement is a legal document that provides detailed information about the financial status of a business or individual who owes money. It includes assets, liabilities, income, and expenses, allowing creditors to assess the debtor's financial situation.

Who is required to file commercial debtor financial statement?

Businesses and individuals that have outstanding debts to creditors are typically required to file a commercial debtor financial statement. This includes companies undergoing bankruptcy proceedings or those seeking to negotiate debt settlement.

How to fill out commercial debtor financial statement?

To fill out a commercial debtor financial statement, gather accurate financial information including assets, liabilities, income, and expenses. Complete the required sections of the form, ensuring all figures are truthful and up-to-date, and submit it according to local or legal requirements.

What is the purpose of commercial debtor financial statement?

The purpose of a commercial debtor financial statement is to provide creditors with a transparent view of a debtor's financial condition, facilitating discussions about debt repayment, restructuring, or bankruptcy proceedings.

What information must be reported on commercial debtor financial statement?

The information that must be reported on a commercial debtor financial statement includes personal or business identification details, a list of assets and their values, liabilities and outstanding debts, income sources, and monthly expenses.

Fill out your commercial debtor financial statement online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Debtors And Creditors List Template is not the form you're looking for?Search for another form here.

Keywords relevant to where to find debt on financial statements

Related to debtor statement meaning

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.